About category management in a reality of change.

Background and trends

1. Consumer and buyer

The last year meant a carousel of changes for all components of the commercial chain: consumer, buyer, retailer, brands.

Can we still talk about a clear buying journey today? Or is everything ambiguous? How much does the change mean from a shopper and consumer perspective?

The change seems big enough to require adjusting and revisiting every touchpoint for businesses.

Several important trends took shape during this period: the shopper and the consumer no longer have such a clear distinction; the sales channels are no longer the classic ones (both in number of options and in terms of sales share); there are more opportunities to interact with the shopper and the consumer, but they are oriented towards known products and brands, have preferences for local brands and products, and those that display a high level of ethics and communicate sustainability initiatives. Old "food waste" habits tend to disappear gradually.

What are buyers' reactions to this period of profound change? 39% of them report abandoning the purchase mission due to queues at the checkout, while 59% of those who make the purchase decision online, still go to the store.

2. Retailers

The new reality means a change of perspective for retailers as well. A new retail mantra is born: loyalty without proximity no longer exists. Two of the major players in modern retail in proximity formats saw increases of 37% (vs LY) and 31% respectively. At the same time, consumers want to be engaged in a personal and consistent way. The ability to forecast and respond to demand is more important than ever, for manufacturers and retailers alike (in these times of peak demand volatility).

3. Brands / Manufacturers

What happens to brands in this change? We see a transition from the concept of "consumer goods" to that of "consumers'passion", understanding an authentic and meaningful relationship between the consumer and the brand, which is the basis of the act of purchase. In this transition, innovation becomes meaningful (it fulfills a promise to the consumer), the brand's behavior is authentic, a "be economy" in which "doing" takes the place of "saying" and "showing". In this attempt at authenticity, the brand also has a very strong self-image - employment brand and corporate reputation - through which employees become brand ambassadors and contribute to gaining consumer loyalty. In the midst of this change, small and local brands are rising, built on authentic values and communication, displaying a high degree of transparency.

And on top of all that, digitization. Not just as a way of existence for the shopper, not just a sales channel, not just a new route to market. 53% of purchase decisions are digitally influenced today. What does this percentage mean? A change of investment – from the shelf to the click, a reoriented attention to the engagement of the consumer online and a construction of authentic storytelling in this environment.

Implications and opportunities. Shopper = consumer

The most radical trend, here, becomes reality. The shopper and the consumer will merge into one and the same entity. As an immediate effect, anyone is the "buyer" (one click away).

Before, brands focused on a handful of consumers (the target segment) and influenced retail traffic through emotional ads. Then the commercial sales force used pricing / execution / promotional tactics to close the sale.

This approach was based on 2 premises:

1. Shoppers fly the isles discovering categories and brands

2. Buying behavior based on the shopping list and influenced by consumers at home.

Today buyers are totally comfortable to purchase one piece of each product and make many transactions, in various sales channels, searching for their products themselves. This major change in the purchase journey (path to purchase) translates into the need to reinvent the go to market process and the concept of path to purchase itself. The immediate opportunity that emerges from these implications is the investment in digital, in the sense of understanding new behaviors (data, analysis) but also content, direct communication, with the aim of supporting sales and increasing the level of brand loyalty.

When we look further into digital, we encounter the following challenges:

• The proliferation of touchpoints in the digital environment determines, on the one hand, a more frequent contact with brands for the consumer online, than in the store • The challenge of time - the online consumer's attention span has reduced to 15 seconds - what is the story that can a brand says in 15 seconds?

The battle moves to the area of SEO, SEM, reviews, video content - educational, product images, product / price comparisons.

The opportunity here is related to the presence and availability of information; opening their own Direct-to-Consumer channel, or a market place, which can provide information and consumer understanding, support long-term sales (subscription model) and invest in consumer loyalty.

Hot spots in today's retail

The main turning points for classic retail are:

• changes in the traffic area (fewer stores visited – from 5-7 stores per week to 3-4, fewer buyers from a family), • less time spent in the store • change and reduction of purchase missions – with increased weight towards stock up • decrease in impulse purchases • transition to small format stores / proximity and online.

But the entire growth chain was affected:

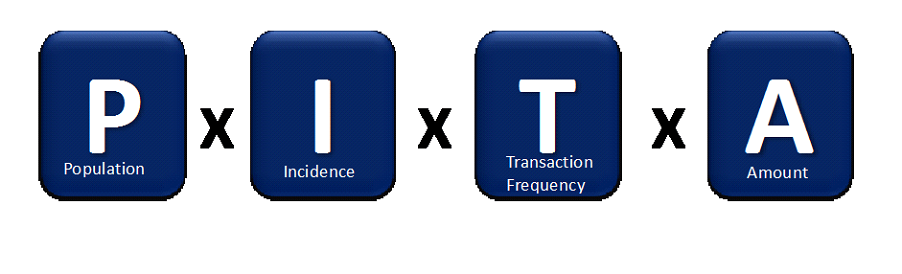

– Less traffic (Population) – Fewer categories visited – Fewer visits – Shopping cart value increased by stocking mission, not by adding impulse products.

Faced with these pain points, retailers will return to fundamental questions – such as – what categories do we sell? What should the store look like? It takes:

• revision of stock management • management of brand portfolios • diversification of services (e.g. click&collect, delivery) • finding new means of customer loyalty

For shoppers, the pain points come from the change in behavior itself – fewer visits, less time spent in the store, are elements that polarize the purchase decision – fewer products, higher volume for basic products, orientation towards private label and value, balanced with the "indulging" need for "indulgence" or "something good" that occupied part of the previous shopping basket.

For brands, a new line of investment opens up, in digital, in parallel with the management of several digital channels, different route to market processes, as well as the need to create relevant content, all of which constitute new pressure areas.

Winners

In this stage of change, with so many angles and challenges, are there still success stories?

Obviously, contextually, the players with proximity formats, but also the discounters had to gain. Those who moved quickly enough in the diversification of services (delivery, online stores) but also showed agility from the perspective of portfolio management, also advanced, winning both new customers and the loyalty of existing ones.

Local brands with Romanian claims have also grown, those focused on CSR / sustainability, brands already available in omnichannel formats, brands that have maintained or even consolidated their marketing investment in these stages. The notoriety of private labels has also increased (in the yogurt category, a private label ends up in the top 3 "most trusted brands"). Counterintuitively, media investment impacted market share during this period.

Category management – where to?

In all this context, among so many challenges and in the midst of change, what is the new role of the category manager?

Firstly we can discuss an extension of the category manager role outside the store as we know it. In this sense, in the purchase planning stage, the mission of a category manager is to follow and influence the decision flow, understanding the needs and motivations of the buyer. In his own "kitchen" the category manager must look at the segments from new angles, resegment where necessary, introduce some new categories. Its practical role follows the new format of the purchase journey, expanding online, following and influencing the new "moments of truth" of the consumer, identifying new methods of interaction with him.

The decision-maker is migrating, if before the decision-maker was the buyer in front of the shelf, today, rather, he represents a courier who acquires each consumer's list, made at home, with brand decisions made online. This migration determines the need for brands and manufacturers to approach the consumer very early in their purchase journey, through the multitude of new channels (social platforms, websites, video streaming channels, messaging apps, mobile apps, etc.) – all of which being able to be in the portfolio of the category manager with attributions in the online area. On the other hand, in these initial stages of the purchase journey, retailers contribute extra services and loyalty offers: pick & mix – online orders, courier delivery, online payment, loyalty programs / cards / discounts, personalized offers , based on the analysis of buyer data.

The decision-maker is migrating, if before the decision-maker was the buyer in front of the shelf, today, rather, he represents a courier who acquires each consumer's list, made at home, with brand decisions made online. This migration determines the need for brands and manufacturers to approach the consumer very early in their purchase journey, through the multitude of new channels (social platforms, websites, video streaming channels, messaging apps, mobile apps, etc.) – all of which being able to be in the portfolio of the category manager with attributions in the online area. On the other hand, in these initial stages of the purchase journey, retailers contribute extra services and loyalty offers: pick & mix – online orders, courier delivery, online payment, loyalty programs / cards / discounts, personalized offers , based on the analysis of buyer data.

Obviously, the list of possible actions is long. Of these, however, I would consider priority:

• data (the ability to track buyer behavior)

• developing the concept of a new category manager (supported by systems, aware and skilled in online, able to understand and create synergies between different sales channels, thus anticipating new categories of consumption)

• the right ecosystem to lead to success (partnerships, online platforms, logistics, etc.) And above all, a clear picture of what success will look like for my brands, for my retail chain.